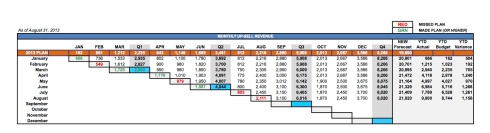

Brian Ascher, a partner at Venrock, wrote a great blog post a while back about how the waterfall model may be the “single best financial reporting tool ever”. That might actually have been an understatement. I highly recommend reading his post, by the way, if you aren’t familiar with a waterfall model and want a good primer as well as the example spreadsheet below.

In a nutshell, a waterfall model allows you to lay out your projections over a period of time (monthly numbers over a one year period; weekly numbers over a year, or daily numbers over a month, for example) and at the end of every period, compare your actuals to your projections then revise your estimates for the periods moving forward based on what you’ve learned. The waterfall model doesn’t provide you with all the answers; however, it gives you a good idea of how you’re doing with respect to your original and revised plans and as a result, figure out what additional questions you need to ask yourself to understand why. It’s an incredibly powerful tool given its relative simplicity.

VCs and Startup CEOs/CFOs have been using waterfall models for decades to measure progress against plan and to help validate assumptions about growth, cash balance, user adoption, and a number of other important business metrics. Outside of the VC/startup/board community, however, waterfall models seem to be underutilized. Maybe it’s because startups need to move quickly. They’re constantly making assumptions, learning, understanding which assumptions were good and which ones weren’t, then revising their plan of attack quickly as they continue to move forward …and a waterfall model helps them understand that and react quickly. There are a few reasons that waterfalls can be particularly helpful in the area of Customer Success as well, given a similar need to move quickly in order to proactively manage recurring revenue:

Reason 1: You need a plan, and you need to know how you’re tracking according to the plan

A waterfall model enforces management to a plan. The interim checkpoints, by nature, hold you accountable to that plan, and if there is a variance, force you to do three things: 1) Acknowledge the variance. If you set up your waterfall model correctly, the interim periods you define should be frequent enough to allow you to take action while there is time to impact the outcome; 2) Ask why there is a variance; and 3) Re-plan the future periods given what you now know.

Reason 2: Your assumptions aren’t always right

Planning, or more precisely, getting a plan right, is an ongoing process. People make plans based on assumptions. Managing an existing customer base can be tricky, and having frequent enough visibility into key metrics in order to take meaningful action allows you to challenge your assumptions with enough time to take meaningful action. One important point to clarify here: This isn’t an opportunity to make excuses for why you didn’t hit your numbers. This is an opportunity for you to understand what you need to do differently to improve your performance (while there’s still time) and create more accurate plans and forecasts in the future. If you do need to re-plan, the waterfall still allows you to measure against your original plan and your revised plan.

Reason 3: Trends are interesting, but without a comparison to your original plan, trends don’t give you the entire picture

Growth is great. Improvements in key metrics are great. In order to run a business and plan/manage it successfully, though, you also need some predictability. Waterfalls provide you with a historical snapshot of how well you did delivering to plan. You always have historical information on your original plan, your re-plan, and your actual performance for each measurable period – in one table. It’s a simple, yet very effective visual tool. If you ended up growing up-sell revenue 25% quarter over quarter is that good? What if your original plan was to grow at 30% QoQ?

So, with all that justification behind us, here’s an example of where and how I’ve used a waterfall model in Customer Success:

Planning and Forecasting Retention and Churn:

I recently blogged about the many Customer Success Automation solutions coming to market to help companies manage a SaaS customer base more effectively. Whether you’re using one of these products or whether you’re just starting to get your head around managing your customer base, it’s very valuable to understand which of the data elements and assumptions you’re using to identify “healthy/reference customers” or “at risk customers” are accurate, and which ones require you to go back and think again.

A team of mine once needed to forecast churn risk from the existing customer base and had very little valid historical information from which we could create projections. We started by looking at customers using broad-stroke definitions of various health levels. We assigned customers a “health status” of Red, Orange, Yellow, and Green, then based on their contract renewal month, assigned a probability of renewal based on that health status. We eventually began adding criteria to more clearly define health status, including usage metrics (not just frequency of logins, but how effectively were they using the system), customer responsiveness, and other indicators of risk associated with their business and usage model. We looked at our first months data and saw where we were off, then went back to our assumptions and looked at where we might possibly have miscategorized customers. We also looked at whether our percentage ratios by health status were accurate (for example, did x% of our “orange” customers actually cancel). We gradually increased our sophistication level as we gathered more data and continued to refine our assumptions in our waterfall model. By the end of our first full year of deploying the model, we were within 5% accuracy forecasting revenue retention and churn.

In addition to forecasting retention and churn, a waterfall model can be useful in other areas of customer success, including:

- Planning and forecasting up-sells

- Modeling the rate at which you plan on improving service levels and/or resultant customer feedback scores

- Planning and forecasting adoption of certain strategic product features across your user base

Pretty much any key metric you want to track and measure against can be managed using a waterfall model. You may want to start with a couple of the ones above, then determine if tracking others will be useful. Just be ready to dig into the underlying data to ask “why” the variances are occurring… and keep asking “why?” until you see patterns emerge. Then act.

Leave a comment