In 2015, I worked on a project with Gainsight and Bessemer Venture Partners, called “The 10 laws of Customer Success”. These 10 laws, written by a group of Customer Success practitioners, have now become the core of the new book Customer Success: How Innovative Companies are Reducing Churn and Growing Recurring Revenue, by Nick Mehta, Dan Steinman, and Lincoln Murphy.

The law I authored, entitled “Your Customers Expect You to Make Them Wildly Successful” has become even more of a reality since I wrote it. The more I engage with sophisticated, successful, enterprise customers, the more their expectation (rightfully so) is that we not only provide them with a product, but that we provide them with the expertise, guidance, and, yes, tough love, that it takes in order to ensure success. In the subscription economy, we’re all stakeholders in our customers’ success.

I’ve re-published the law I authored below:

Customers don’t buy your solution to use its features and functions. They buy your solution (and buy into the relationship with you) because they want to achieve a business objective. Just as sales organizations are using a “Challenger” sales approach, Customer Success organizations need to provide new insights and challenges. As Ben Horowitz said in his 2015 commencement address at Columbia University: “There’s no value in telling someone what they already know.”

The value your customer places in your relationship isn’t defined only by your product’s features and functions; it’s also defined by everything else your company does to help make your customers better at what they do. That includes enablement, content marketing, online resources, and in the case of relationships with larger enterprises, direct engagement by subject-matter experts. In some cases, delivering a message that goes against conventional (and popular) wisdom can be difficult, but in the end, delivering a challenging message that is in your customer’s best interest will strengthen your relationship

Delivering wild success requires you to understand three fundamental things:

- How is your customer measuring success? In other words, what is the customer’s unit of measure (time saved, incremental revenue, reduced cost, specific financial impact of increased quality), and what results does the customer need to declare victory?

- Is the customer achieving that value (or at least on a realistic path to achieving it)?

- What’s the customer’s experience with you along the way?

Wild success doesn’t happen by chance. It happens because both you and your customer have a real stake in mutual success, you both share and understand those objectives, you measure and monitor progress against those objectives, you ask hard questions, and you continuously strive to raise the bar when setting new objectives.

The truth is that it takes more than a great product to make your customers successful. In the enterprise, you’ve won the deal because your sales team has done an outstanding job of selling the benefits of your company, painting a vision, and setting expectations that there will be significant payback with your solution. In a recent customer meeting, a forward-thinking CIO expressed to me his concern with many software vendors: “None of them challenge us. They come in, install the software, and then move on. I’d like to understand what we’re currently doing that we should be doing differently. We’re not just paying for a product—we want expertise as well.” In a sense, he was telling us: “You sold us on vision and expertise. That’s our expectation. Now deliver.”

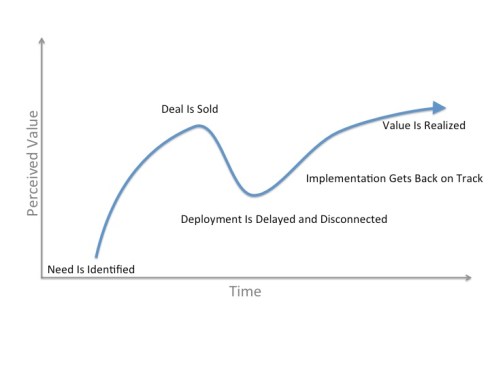

Unless you can start by delivering some value quickly, while executives are still excited, you risk losing momentum and falling into a pit in a success curve that resembles the “Trough of Disillusionment” in Gartner’s Hype Cycle.

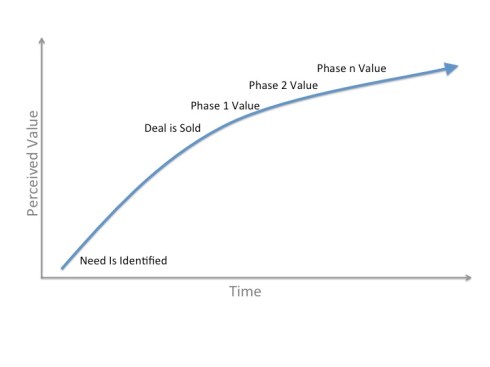

With early proof points, your customers’ perception of success will be on a much flatter curve:

With early proof points, your customers’ perception of success will be on a much flatter curve:

In addition to ensuring that you’re tracking to ultimate success for your customer, set your customers up for a quick win. Define an initial milestone and track that time to first value (shown in the chart above as “Phase 1 Value”). It may be as simple as delivering an initial proof of concept with basic functionality, but it will quickly provide evidence to your customer (both your immediate sponsor as well as executives or board members) that the decision to go with your technology was a good one. It’s also important to prove value quickly, since any expansion plans you may have with the customer will be predicated on your success. Early wins keep that momentum going. An early win will also be extremely helpful if you encounter any challenges (technical, business, environmental, or political) in future phases. It will allow your sponsor to point to the value already achieved as a way to flatten obstacles and rally support.

In addition to ensuring that you’re tracking to ultimate success for your customer, set your customers up for a quick win. Define an initial milestone and track that time to first value (shown in the chart above as “Phase 1 Value”). It may be as simple as delivering an initial proof of concept with basic functionality, but it will quickly provide evidence to your customer (both your immediate sponsor as well as executives or board members) that the decision to go with your technology was a good one. It’s also important to prove value quickly, since any expansion plans you may have with the customer will be predicated on your success. Early wins keep that momentum going. An early win will also be extremely helpful if you encounter any challenges (technical, business, environmental, or political) in future phases. It will allow your sponsor to point to the value already achieved as a way to flatten obstacles and rally support.

Installing software on-premises, provisioning a user account for a SaaS solution, or even providing basic training on the functionality of your product are simply table stakes. Those activities get you in the game, but they aren’t what make you win. If your company innovates—and which successful ones don’t?—it’s important that you outwardly communicate the benefits of that innovation and, critically, how your customers should use your capabilities to be more effective at what they do. Great companies need to provide this expertise and guidance in a way that scales. It isn’t just about having highly skilled professional services consultants who come in on a feefor-services basis (although that’s very important when serving the enterprise, as well as some subset of highly technical solutions). You’ll also need great content (knowledge base, best practices, how-tos) and an efficient means for delivering it.

The main reason why your customer bought your product in the first place isn’t because your features are cool. It’s because your customer has a job to do and expects your solution (and your company) to help them do it better. For example, if your company provides a digital marketing solution, you need to provide the tools, technology, training, and supporting content to make your customers better digital marketers, not just a tool that allows them to send emails. More importantly, you need to continuously provide the customer with examples of how they can use your solution to be more effective, how other customers are using it to be more effective and, if you have the aggregate data, how some of the customer’s key metrics (usage or otherwise) compare to similar companies or industry averages. Without a benchmark of comparison or a target to achieve, the customer’s current performance data has limited value.

To Help Your Customers Become Wildly Successful, You Must First Understand What Success Means to Them

To manage your customers through the journey of wild success, you always need to know three things about them:

- How are they measuring success? Specifically, what is the key metric, or “unit of currency,” that they’re using to measure success, and how many units will the customer need to add/save/remove/reduce to claim that they’ve gotten value from your solution? You should also know how the customers as a team (irrespective of your solution) are being measured for performance.

- According to that metric (or metrics), are they achieving success? Or, if it’s a work in progress, is the customer on track to succeed within to the expected time frame?

- What is their experience along the way? While the first two questions are pretty clear-cut and quantitative, this one is less so; however, it is incredibly important. It will drive the tone of your relationship and interactions with your customers. Even if your customers achieve their objectives using your technology, if their experience is painful and requires more effort than they believe is necessary, then you’ve significantly increased their cost (both tangible and intangible) of achieving success.

ROI Isn’t a Concept; It’s an Equation

Another area that receives intense focus during the sales cycle but may fall through the cracks after implementation is the quantification of ROI. If you’re a provider of Customer Success solutions, your customers might have the following objectives:

- Reduce churn

- Find upsell opportunities

- Improve the ability to scale their team

While it is difficult to attribute the degree to which your solution is helping the customer achieve each of the three preceding objectives, the first thing to do, if possible, is quantify the expected results. For example, reduce churn by how much? Identify how many new upsell opportunities, and of what size? How much total value? How much productivity gain do you expect to see in your team? How do you measure productivity? Is there a way that you can tie use of the product (or particular features of the product) to team scalability? Can you identify a few key metrics associating health scores for a certain percentage of customers in a certain tier as a point of first value? After you understand the expectations, set them as a clear target.

Get on a Cadence and Track Your Progress

Use regular business reviews (with your higher-touch customers) as a way to track progress toward the objectives and targets you’ve jointly defined. If your customers understand that you have a vested stake in their success and you share a common objective with them, they’ll be willing to engage with you on a regular basis to collaborate on how they can get there. Regular strategic business reviews (SBRs), quarterly or otherwise, focusing on these objectives give you and your customers a reason to engage on a regular basis. These objectives also help frame the conversation for a business review. I’ve seen too many quarterly business reviews (QBRs) poorly attended because they weren’t working toward clearly stated and understood success criteria. Product road map updates and a review of open support cases will carry a QBR only so far. In fact, a QBR that covers only those topics is extremely defensive. There’s no way for you or your customer to win if all you’re talking about are features that don’t yet exist and features that aren’t working properly.

A business review must be part of a broader context of a journey to well-understood success. If you have a clear understanding of the customer’s success criteria, then at the end of each SBR, you should be setting measurable objectives for the next one. I met with a customer recently who has an objective to migrate billions of rows of data to a new repository within the next two months using our product. While our CSM is going to have a number of conversations in the interim to ensure that the customer achieves that goal, the larger team is certainly going to review progress against that quantifiable objective in the next QBR.

Success Isn’t a Destination; It’s a Journey

While your customers may have set out initial success criteria, part of the value you bring as a partner is helping customers define what they should think about next. You know and understand the value your product can potentially bring to your customers. You also know how other customers are using your product successfully. This is a perfect opportunity for you to give your customers guidance about what they should be thinking about next. If they just used your Customer Success automation product to increase their retention rates from 85% to 88%, you now have an opportunity to show them how best-in-class companies are achieving 90%+ renewal rates—and how your partnership can help them get there. For lower-touch customers, you can achieve this objective through content marketing and communication of online best practices. For higher-touch customers, this can (and should) be an opportunity for executive alignment. It’s an opportunity to influence each other’s strategy, as well as an opportunity to strengthen the relationship. A good tool to use to help drive customer direction beyond first value is an effectiveness model that you can use to set objectives and timelines to help your customers better achieve their business objectives via your partnership.

In Theory, There’s No Difference between Theory and Reality—But in Reality, There Is

All this sounds great in theory. However, unless you have perfect alignment and agreement on everything throughout your customer relationship (starting with the sales process), you’re going to have cases in which customers won’t come to the table, won’t provide you with key data, will be challenging and confrontational, and may have a different understanding and set of expectations than you do—possibly thanks to an overly optimistic sales effort. You may run into challenges with your product. Your support or services organization may not always deliver impeccable service. All I can say is: Welcome to Customer Success. These are all challenges that you have to deal with, and you must have difficult conversations as soon as possible when issues arise. Issues won’t go away by themselves. Customers, however, will.

Approached properly, these conversations are, at minimum, incredible learning experiences. The best perspective for your company to take is to look at itself through the lens of your customer. No matter how hard you try to imagine how your customers feel about something or what they think, you won’t know until they tell you. Candid customer conversations are a valuable source of information—sometimes epiphanies—for your company.

Challenging times are also a great opportunity to cement a relationship. I have heard it said that the strongest steel is forged by the fires of hell. If you’ve worked through a difficult situation collaboratively with a customer and shown your true colors as a partner; or if you’ve accepted responsibility, identified short-term milestones— then met those milestones—regained trust, and made your customer successful, then you’ll understand and empathize with this statement. If customers aren’t following through on their side of a commitment, then you’ll need to escalate, strategize with your sales team or other business functions, and figure out how to have the necessary difficult conversation with the right person or people. Customer Success is everyone’s responsibility. Use all the resources available to you. Your customer is expecting you to.

It’s true that customers expect you to make them wildly successful. It’s also true that they’re highly motivated to be wildly successful with you. In fact, they’re at least as big a stakeholder in your mutual success as you are. Your customers are demanding because they want to be successful. Challenging your customers isn’t always an easy task. It requires a relationship, mutual respect, and a sense that you both are working toward the same objective. A customer told me recently at a dinner meeting: “The challenge you posed to us was difficult for us to process and accept. We initially took offense that you, in essence, were telling us that we were wrong, and that caused some tension. Ultimately, however, because we felt that you were in the same boat with us, we accepted it. As a result, it has strengthened our relationship.”

Customer feedback about your opportunities for improvement isn’t always as obvious as an escalation or challenge. In most cases, you need to be paying attention to the more subtle clues that there may be risk to your customers’ success. Many times, those clues are in what they don’t say rather than what they do say. Risk might be indicated by a change in schedule or priorities. In any of these cases, it’s critical to get to the root cause of the issue and understand what course corrections you need to make to drive Customer Success.

Remember, your customers aren’t buying a technology. They’re buying a solution to a problem, a path to a better way. It’s your responsibility to understand the customer’s goals and objectives and steer the customer along that path (in both high-touch and low-touch ways). Once you’re able to understand how customers are measuring success, confirm that they’re achieving it, and confirm that they’re having a positive experience along the way, you’ll have the most valuable thing possible: an advocate. And in a world where social media and the network are accelerants that help both negative and positive opinions spread like wildfire, advocacy is priceless.

In combination, the Challenger Sale methodology and the rise of content marketing have created an environment in which customers expect that they have purchased more than just a product to use. They’ve entered a relationship with a company that is going to make them more effective at achieving their business objectives. As a result, the CSM (as well as the entire customer-facing team) need to grab the baton and take on the role of challenger throughout the customer life cycle. Wild success doesn’t happen by chance. It happens because someone asks hard questions, objectives are measured and monitored, and once those objectives are achieved, someone raises the bar and repeats. Welcome to (wild) Customer Success.

You must be logged in to post a comment.